Financial Fraud Prevention is Broken. CheckMate is the key to fixing it.

Cyber criminals have realized that to rob a bank they no longer have to break in. The banks’ customers will (unwittingly) open the front door for them. Authorized Fraud has left banks’ defenses irrelevant and their customers exposed.

CheckMate is the solution both have been waiting for.

The Perfect Fraud Storm

The battlefield of financial crime is fast changing. Increased adoption of real time payments, the rise of new disruptive technologies and breakthroughs in the fight against unauthorized fraud, have set the stage for an eruption of Authorized Fraud. It is no longer sufficient for banks to solely protect their customers’ accounts; They must now protect the customers themselves.

Real-Time Payment Transactions

In 2022

US & UK projected scam losses

Is Fraud

That’s where Checkmate comes into play

Authorized Fraud Prevention Reinvented

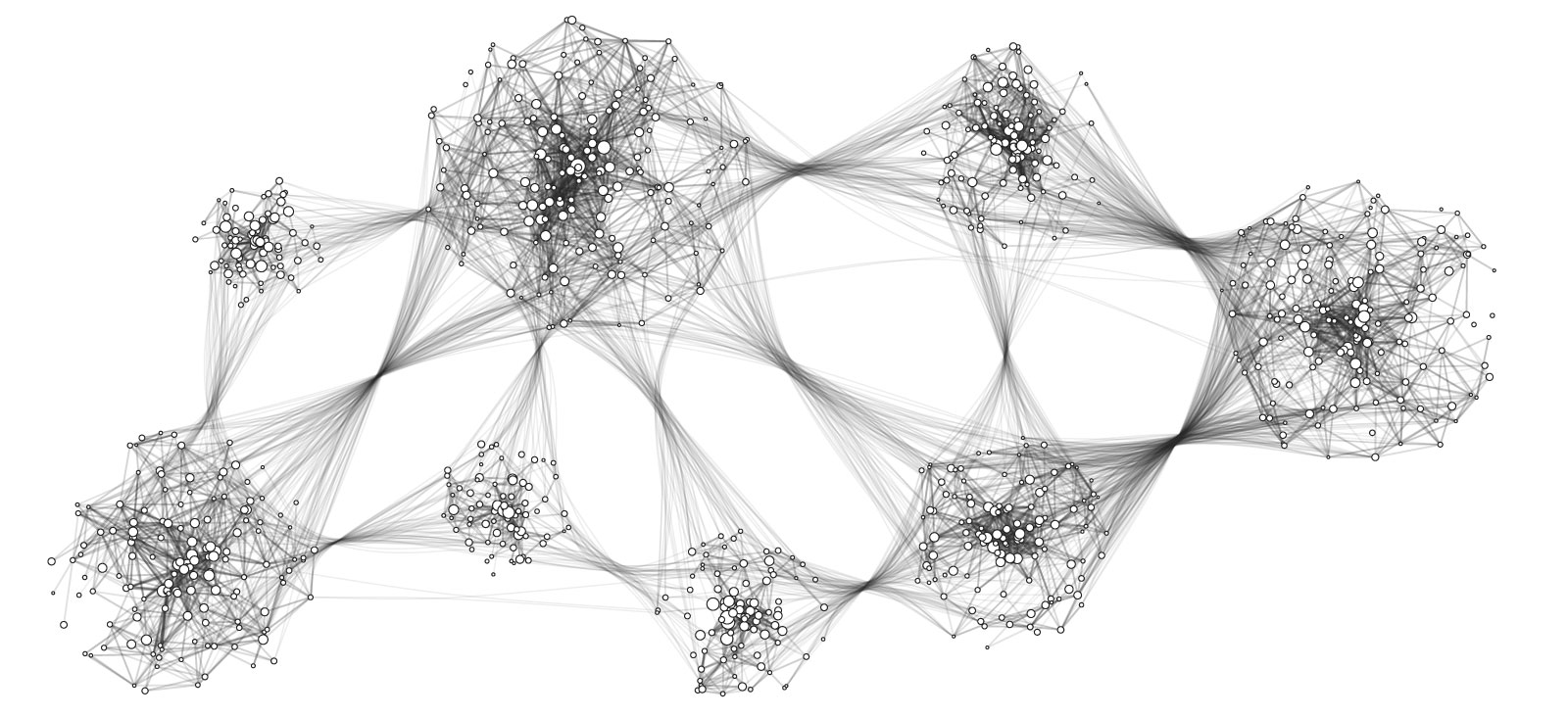

Machine Learning & Graph Data Science

Rule engines are insufficient to detect authorized fraud. Therefore, CheckMate used machine learning and graph data science to provide the much-needed context for detecting mule activity and preventing authorized fraud.

Real Time Monitoring

Faster payments means faster fraud. CheckMate scores all payments in real-time.

Ease of Integration

Adding or replacing a current fraud detection workflow is a heavy lift for banks. CheckMate can easily integrate into existing workflows of the fraud department via APIs, such that there is no need to replace or add UI to benefit from CheckMate's value.

Beneficiary Scoring

In Authorized Fraud most anomalies will appear on the Receiver side, yet legacy systems analyze Sender behavior. CheckMate scores Receiver accounts based on their unique data.

Security and Privacy

Data security and privacy are a bank’s top priority. With no customer data leaving the bank, CheckMate meets the highest standards of security and privacy.

The Checkmate Leadership

Our Founders

Advisory & Board

Ex Head of Open Banking Implementation Entity UK; Ex Global Fintech partner at EY

Ex Global Payments Technology Chief Information Officer (CIO) at Barclays; UK Payments Industry Expert

Founder, CEO and Chairman of multiple Fintech Unicorns: Fundtech (acquired by Finastra), ezbob, Earnix

Managing Partner and CTO of The Garage; Former Head of Cyber Security & Head of Data Science Department of Unit 8200, IDF (equivalent to NSA)